Structured settlements have been extensively employed in physical injury and workers compensation claims for nearly 50 years. Often referred to as “qualified structured settlements,” these specialized annuity plans (1) offer guaranteed future periodic payments, (2) are paid free of federal, state and local income taxes and (3) can be tailored in nearly infinite ways to dovetail with the claimant’s future medical and life care needs. Moreover, life contingent plans offer the added – and critical – benefit that a claimant “cannot outlive” the lifetime payments.

However, most attorneys are unaware that “non-qualifed” structured settlement plans are also available for taxable damage claims, such as employment claims, emotional distress (only) claims, slander/libel claims, punitive damages, business disputes, alimony/child support claims, legal malpractice, etc. Likewise, your attorneys’ fees can often be structured especially in contingent fee cases. Non-qualified structure plans, if properly set up before final resolution of a claim, also offer guaranteed payments, significant tax savings, and flexibility in plan design.

But, too many attorneys simply do not know that their clients could save significant income taxes by structuring their recovery. In fact, fas a cash settlement. will nearly always result in the claimant paying far more in income taxes than with a structured settlement. It also does nothing to avoid the very real risk of premature dissipation of those settlement funds.

WHY IS THIS?

If the claimant takes a taxable settlement in cash, the total amount is deemed to be received in the year of settlement for income tax purposes. Thus, federal, state and local income taxes are due on 100% of the settlement in that same tax year. In larger settlements, the claimant will have even higher tax rates, as each level of the income tax brackets are reached. And, in extremely large settlements, the claimant may be required to pay supplemental and Alternative Minimum Taxes (AMT).

Often, a claimant – and the claimant’s attorney – may both end up paying close to 50% in federal and state income taxes, a not-insignificant portion of their settlement. Of bigger concern in these cases, the claimant has a real risk of loss of principal after paying the taxes, due to market volatility, high investment fees, commissions, etc.

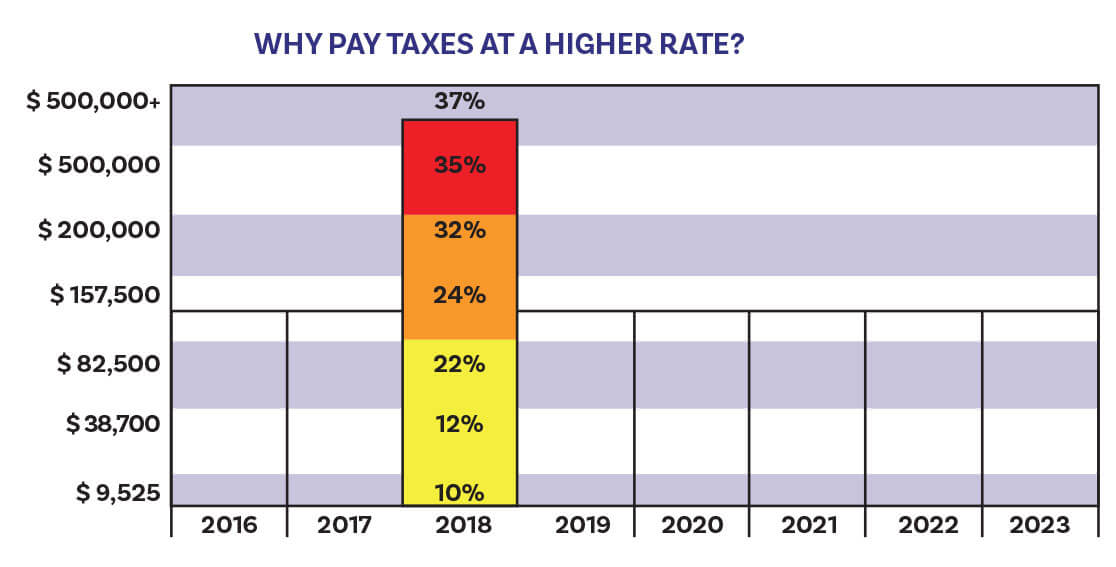

The chart below illustrates the various tax brackets for an individual earning more than $500,000 in annual income. Some of the income is taxed at lower tax rates, but as the individual receives more income, the tax rates increase significantly. Note that these are for federal taxes only – the true percentages would be even higher once state taxes are included.

EXAMPLES

With a taxable cash settlement of $600,000, only a small portion of that settlement would be taxed at 24% while the majority would be taxed at 35% to 37%. If the settlement is over $500,000, the tax rate rises even further due to the complications of the Alternative Minimum Tax. If an unmarried claimant receives a cash settlement of $400,000 (net of attorney fees and expenses), a quick estimate of the tax hit shows the claimant paying $153,047 in federal taxes, leaving him/her only $246,953 before he/she pays state income taxes.

However, if the claimant structured the above settlement with a 5-year plan of 60 monthly payments, he/ she could have an annual income of over $80,000/year (depending on rate variations and other plan variables). If federal and state tax brackets were to remain consistent over this 5-year period, the claimant could potentially save over $40,000 versus paying the tax hit on the entire upfront cash settlement.

We recently set up a structure in a Nebraska case where the claimant was to recover $600,000. The structure plan which the claimant chose provided monthly payments over a 12-year period. All future payments were guaranteed and were placed with a well-known life insurer with an A++XV rating (the highest rating from A.M Best’s). The plan provided the claimant with an annual income of $59,075. Our calculations demonstrated that, assuming federal and state income tax brackets remain consistent over the next twelve years, the federal and state tax savings would be approximately $86,093. The claimant and his attorney clearly understood the tax implications of the structure. And, the claimant was determined to keep as much of their settlement as possible.

In another recent case here in North Carolina, the 56-year-old, married claimant was employed and did not immediately need any of the $450,000 settlement recovery. He elected to defer the structure benefits until his 76th birthday. At that time, he will receive nearly $4,000/month for 20 years. His CPA estimated the claimant’s tax savings at over $120,000. Moreover, he was not only able to defer the taxes due on the $450,000, he was also able to defer taxes on the guaranteed returns compounding within the annuity. Had he taken upfront cash – and then paid the income taxes in the same year as the settlement, he would need to earn a 6.8% guaranteed rate of return for the entire 40-year period to net the same $4,000/month income guaranteed from his structured settlement. In addition to the tax savings shown by his CPA, the claimant’s financial advisor planner also agreed that the structure was the best financial option. Why? Because there was simply no investment product that would guarantee a return sufficient to match his guaranteed structure benefits.

Finally, our most recent non-qual case involved a $3,000,000 wrongful termination settlement. In this case, the mediator suggested that the parties consult with me to bridge a significant gap in the settlement demand and the defendant’s offer. Our structure proposals did just that. Although we cannot structure the lost wages portion of such a claim (due to the various withholding requirements and other tax implications), both the claimant and his attorney wanted to structure their remaining recovery amounts. With the flexibility we have in plan design, the claimant was able to set up monthly payments of $17,500, beginning on January 1, 2020, for five years. The attorney set up her structure plan to pay monthly benefits of $11,000 over 10 years. The claimant and his attorney had their CPA’s and financial advisors carefully review their financial planning options. Given the significant tax savings of the structure plan, the CPAs and financial advisors readily endorsed both structure plans. And the case was resolved.

ADVANTAGES FOR THE DEFENDANT

As in the final example, a primary advantage to the defendant in these cases is resolving a difficult and thorny case. Because the provisions of the structured settlement must be fully set out in the final settlement documents, and a “non-qualified assignment and release” must also be executed by the parties, the defendant is provided a full and final release of all liability, including any liability to make the future periodic payments provided in the structure. Likewise, the defendant or its insurer may write off the liability for the claim on their books in the year of the settlement. Insurers can thereafter release their reserves on the claim. And, federal tax regulations provide that the settlement amounts paid may be deductible in the current year, not spread over the life of the structured settlement annuity. Moreover, because of the non-qualified assignment to the annuity issuer’s assignment company, neither the defendant nor its insurer holds or owns the annuity contract, and therefore it is not an asset or obligation to be carried on their books in future years.

Thus, the non-qualified structured settlement is a win-win for all parties to difficult and often complex litigation. We believe it is critical to engage our services as early in a claim as possible so that we can meet with you and your client, and explain the various options available to you both. Moreover, we always recommend that you and your client speak to a CPA to verify our tax savings estimates. Over the past 10 years, every claimant who has involved their CPA in our cases has had the CPA recommend the structured settlement product, even for short 4-5 year time frame. Attorneys, claimants and their CPA’s can design the future payment stream in a manner most suitable for them – short term, long-term – as well as defer the benefit commencement date far into the future.

Call me at any time to discuss the options available to you and your client. We are also happy to point you to pertinent tax rulings, statutes and IRS regulations (although we do not provide actual tax advice). Tacker LeCarpentier