If his life were depicted on the Big Screen, audiences would undoubtedly reject its veracity, chalking it up as just another Hollywood hyperbole. After all, other than idealized fictional composites such as James Bond, Rambo, or Atticus Finch, how many people do you know capable of gliding between imposing ideologies with the ease of changing from camo to tux? More importantly, how likely is it in “real-life” to meet someone whose personal history includes experiences as dramatically impressive as they are numerous and varied?

Donald W. “Mac” MacPherson is just such an anomaly. With fearlessness and determination, Mac takes on opponents from which most people flee, whether those opponents be furtive enemies in the jungles of Vietnam or the seemingly indomitable IRS. His is a life so full, so abundant, that it’s difficult to believe these are the experiences and accomplishments of just one man.

DEVELOPING DISCIPLINE

If it’s true that discipline is an essential element to success, then Mac’s course was set early in life. His military career began at the ripe old age of six. Mac’s father, Malcolm Douglas MacPherson, attended Admiral Farragut Academy and wanted to attend Annapolis but was not medically qualified. He died of a heart attack when Mac was just two years old. Without the influence and guidance of his father’s strong military presence, it’s likely that Mac’s mother determined the best alternative could be found in some of our country’s finest military educational institutions.

When most young lads are trying to master the mechanics of riding a two-wheeler and still occasionally hiding behind Mama’s skirts when approached by a stranger, Mac and his older brother were attending St. Aloysius Military Academy in Fayetteville, Ohio, a Catholic boarding school operated by Sisters of Charity of Cincinnati since 1913. When the school closed with 18 sisters and 102 cadets, the brothers attended Millersburg Military Institute in Millersburg, Kentucky, where Mac completed third and fourth grade. Both schools surely helped establish positive, life-long traits.

“From the time I was six years old my dream was to attend a service academy,” says Mac. “I thrived on the regimen and was proud to be following in my father’s footsteps.”

Not surprisingly, Mac won a Congressional appointment to West Point directly from a Cincinnati high school where he played football and was recognized for his performance as a swimmer, breaking several butterfly records. With the same dedication that has been the hallmark at every juncture in his life, after earning a Bachelor of Science in Engineering Science at West Point, Mac qualified Airborne, Ranger, and Infantry and volunteered for 18 months of combat in Vietnam, where he served as an infantry platoon leader and company commander with the famed 173rd Airborne Brigade (Separate).

He was awarded several Air Medals, numerous Bronze Star Medals and the Vietnamese Cross of Gallantry with Silver Star. He later served as a Jump Master and Special Forces (“Green Berets”) A-Team Commander.

After Vietnam, Mac taught ROTC at the University of Cincinnati, coached the rifle team, and was, as in the 2009 movie The Messenger, a Survivor Assistance Officer, responsible for notifying the next of kin of the loss in Vietnam of their husband or son. He was also responsible for the wake, funeral, and posthumous award ceremonies.

NEXT CHAPTER

Mac was an 18-year-old West Point cadet when he met future wife Barbara. She was just 15. Even at this young age Mac knew his mind and following a lively courtship and his Vietnam tours of duty he made that commitment official: they married seven years later, in 1970. Coming up on their 49th wedding anniversary, the couple proudly point to the three sons of whom they are (with good reason) very proud: Scott, Ryan and Nathan, plus12 grandchildren.

Departing from his impressive military career with the rank of Major, Mac says he was ready for the next chapter to begin. “I was an attorney in search of a practice,” he says. “Then, in 1978 we moved from Oklahoma to Phoenix.”

Making Arizona their new home, Mac established his own practice from which he would launch countless battles against forces he deemed a threat to both his clients and our Constitution. Forty years later, Mac’s client roster has included two governors, three state senators, two CIA operatives, two Hollywood stars, and a major U.S. airline. No, he never joined a firm but instead launched what would be the beginning of an impressive, influential and dogged dynasty — The MacPherson Group. Carving out a niche that few would have the fortitude and stamina to approach, fighting for those whom the Internal Revenue Service targets.

Bolstered by an internal conversation, Mac found an area where he could apply his intellect, experience, and inherent belief in the rights of every American citizen.

“I essentially told myself, ‘If you are afraid of your own government, you might as well move to Russia,’” he says. “I figured if I was willing to volunteer twice for Vietnam, spend 18-months there, mostly in combat, why should I tremble at the thought of being tailed by Treasury Agents?”

In addition to an extraordinarily successful legal career, taking on one of the most feared branches of government, Mac has authored several books, including Tax Fraud & Evasion: The War Stories. The “Courtroom Commando” as he’s been dubbed, is the only attorney board certified by a state bar as a specialist in both tax law and criminal law. His record speaks for itself, having tried 55 criminal tax cases across 25 states.

His knowledge and experience with criminal law, trials, and appeals as well as tax law, has proven invaluable in the cases the firm has handled over the years, including the areas of civil and criminal tax controversies of all types. These range from audits and criminal investigations, many of which were dropped, to appeals to the United States Supreme Court where he won a criminal tax case.

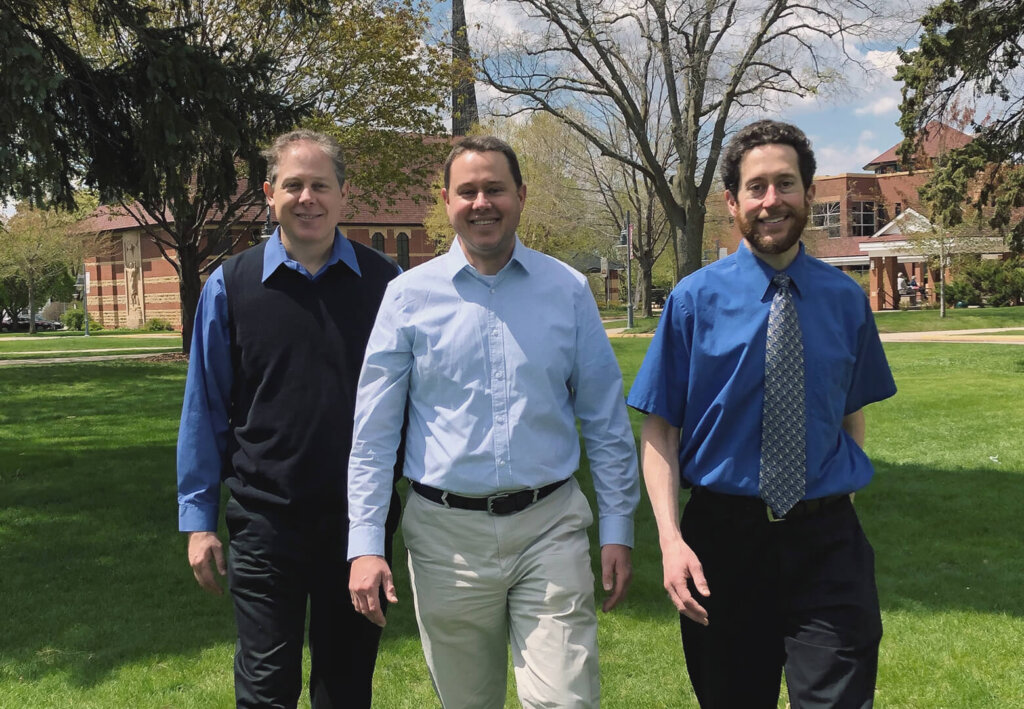

Building, nurturing and maintaining this unique practice for the last 40 years, Mac has passed the baton to his three highly-capable sons.

“I’ve been preparing them all of their lives for this,” he says. “I never allowed my career, about which I’m obviously passionate, to come between my family and me. The best way to do that was to involve all three sons and my wife in my practice.”

And so, the legacy is continuing with Scott and Nathan as civil and criminal tax controversy attorneys, and Ryan, a college professor and book author with a doctorate from Notre Dame, the financial consultant for the firm.

THE THREE MACPHERSON SONS AND HOW THEY GREW

The obvious question is, how do you fully involve young boys in a practice so demanding and complex as The MacPherson Group?

“At every stage of their lives, whatever their age or capabilities, there were contributions each son could make,” explains Mac. “In the beginning it was primarily just a question of ensuring they were in attendance at the various trials. Barbara is a paralegal, so she has been involved from the start. Nathan and Ryan were on their high school Mock Trial Team, which Barbara and I coached.

“I tried cases all over the country and would pack up the whole family to travel with me, so that the boys specifically could see first-hand what their father’s work involved,” he continues. “Gradually, as they got older each son actually participated in the courtroom presentations.”

From courtroom assistance by Barbara, trial exhibit preparation by the boys, including “brainstorming” and rehearsing direct and cross-examination of witnesses, the trial attendance and assistance became a family affair.

“Scott, at age 19, prepared the exhibits I used successfully arguing before the Arizona Supreme Court that impeached Governor Evan Mecham could again run for office,” explains Mac. “These experiences enabled the boys to both witness and be involved in the ‘West Point systems engineering,’ cutting edge strategies and tactics that I employ and have resulted in many client victories in both civil and criminal tax cases.

“My wife and sons have also assisted with the writing, proofreading, editing and desktop publishing of my three tax books.”

Because his cases frequently took him across the country, the entire family would oft en climb aboard the firm’s 1963 Cessna 205. This sixseater, piloted by Mac with Barbara as navigator, carried the MacPhersons to trials in California, Montana, Kansas and New York. It also served the family well when they would travel to different locales for Mac’s numerous speaking engagements. Barbara and Nathan accompanied Mac to Bismarck, where in one trial Mac won acquittals for all five of his clients, “The Fargo Five.”

Mac would make sure that it wasn’t all work and no play, frequently taking his family on side excursions to destinations such as West Point, Coast Guard Academy, Merchant Marine Academy, Martha’s Vineyard, and New York City. Scott also became a pilot.

HEIRS APPARENT

As adults, Scott, Ryan, and Nathan have remained close to one another, their parents, and the family business. Each man, successful in his own right, is poised to take over specific aspects of the MacPherson legacy.

SCOTT. An accomplished attorney, married 23 years and father of three, ages 15, 17, and 22, Scott brings more than a decade of experience representing clients before the IRS and numerous state taxing authorities in all stages of civil controversy, as well as extensive criminal appellate work. These include audit, appeal, assessment, collection, lien/ levy, Offers in Compromise, Installment Agreements, Currently Not Collectible status, Collection Due Process Hearings, U.S. Tax Court litigation, appeals in the federal circuit and petitions for a writ of certiorari to the United States Supreme Court.

With a Master of Science degree in mathematics from Purdue University as well as his Juris Doctor from Chapman University, Scott is licensed to practice law in Arizona, California and the District of Columbia.

His recollections of growing up in the MacPherson legal practice are filled with adventure and wonder. “It was exciting to sit in the actual courtrooms and listen to the lawyers presenting arguments to the judge and jury. And when I helped make an actual trial exhibit, I felt important because I knew that I was helping him with something very big and very important.”

When describing his father, Scott doesn’t hesitate. “Aggressive, dogged and determined. I’ve never seen anyone so committed to protecting his clients. It’s almost as if he thinks there’s an S on his chest. He’s like a pit-bull when the situation calls for it. He won’t give up.”

Not unlike his father, Scott has lived a fascinating life thus far, with varied interests that range from software development for defense contractors such as TRW and Northrop Grumman, to practicing/mastering martial arts for more than two decades, to serving as a teacher/facilitator of substance abuse classes for a state-licensed counseling facility.

Like Mac, Scott is a prolific writer, having edited two books on federal tax law, authored a feature article for a Scottish heritage magazine, two articles for a martial arts publication, several online articles for examiner.com and three for eHow.com. Additionally, he’s self-published two books.

A featured speaker at the Tax Freedom Institute’s annual Taxpayer’s Defense Conference, Scott has also been an editor and contributor to their monthly newsletter which has an extensive readership amongst tax professionals across the country.

NATHAN. Equally accomplished, brother Nathan seems to have caught the travel bug, no doubt inspired by the many trips he and his brothers enjoyed with their father.

“I have been to 49 states (not yet Maine) and 25 foreign countries,” he says. “My wife and I met in Cologne, Germany, I’m from Phoenix but she is from Brazil. Our two oldest boys were born in Frankfurt, Germany; the youngest was born in Encinitas, California. Our children are bilingual (English and Portuguese) and my wife and I are fluent in German as well.”

Nathan is not only a California attorney, but is also a Solicitor of the Senior Courts of England and Wales, having worked as an associate at the world’s second-largest law firm in its Frankfurt and London offices where he represented global banks and finance ministries. Even today Nathan often works from remote locations, such as while visiting clients or researching issues, both in the United States and offshore. When he is not traveling on business, Nathan works from his mountaintop acreage in North Idaho.

Nathan’s practice focuses on both federal and state civil and criminal tax defense, including complex income tax and employment classification audits, trust and off shore/foreign issues, and related white-collar crime such as money laundering, gold, and Bitcoin issues. A recognized expert at Offers in Compromise and other collection alternatives, Nathan also handles administrative appeals, Collection Due Process Hearings, and U.S. Tax Court litigation. Additionally, he defends DOJ suits to reduce tax debts to judgment and foreclose on real property.

Nathan’s childhood memories are virtually identical to Scott’s, highlighted by the numerous opportunities to travel and the excitement of witnessing his father in the courtroom.

“I had a wonderful childhood,” he says. “Not only did we get to attend many of my father’s trials, but we were also included when he and the clients would go out to dinner. I always found those dinner conversations fascinating, learning about the different backgrounds and experiences of each client, the issues and strategies of the case, and seeing many of these same clients and their cases in the news when we went home or back to the hotel. Now I am raising my children the same way, traveling with me and meeting my clients, even taking my firstborn to visit clients from Bank of America in Luxembourg (they loved it and I became their favorite attorney!). In the past six months we’ve been to 25 states visiting clients. My father discipled me, and I am now discipling my children.”

Perhaps most notable among this young international lawyer’s recollections is the trip from Phoenix to the Grand Cayman Islands in a chartered jet. “I was 12 and my father was representing a young man in his 20s accused of running an off shore Ponzi scheme; he flew us to the Caymans to meet with his off shore bankers. This case is probably one of the reasons I ended up majoring in finance in college, something that helps me turn tax issues into opportunities for my clients.”

Nathan may enjoy the adventure of global travel, but like his father, is steadfast and immovable when it comes to family and faith. He and his wife recently celebrated their 16th wedding anniversary, they classically homeschool their three sons, ages 6, 8, and 10, and Nathan is an elder of their Lutheran Church-Missouri Synod parish.

When describing his father, Nathan’s words are remarkably similar to Scott’s. “He’s a pit-bull,” he says. “He’s tenacious and relentless. He eats, breathes and sleeps tax law, especially criminal defense, and analyzes cases from every possible angle, like playing 3D chess. That’s what we mean by ‘holistic tax solutions.’ We look at the big picture and every aspect, every possible iteration. That has been true throughout my father’s career, and now The MacPherson Group has two generations of tax defense attorneys carrying on the tradition of service to clients.”

RYAN. Mac’s second son Ryan attained a Ph.D. in History and Philosophy of Science from the University of Notre Dame in 2003. He serves as a legal researcher and financial advisor to The MacPherson Group. In addition to assisting the firm in appellate litigation, Ryan also authored an amicus curiae brief in the California Proposition 8/Marriage Amendment case, Perry v. Brown (9th Cir. 2012) on behalf of a nonprofit ministry he founded, The Hausvater Project (www.hausvater.org), which mentors Christian parents.

Ryan teaches courses in American history, legal studies, and philosophy at Bethany Lutheran College in Mankato, Minnesota, where he serves as Chair of the History Department and was instrumental in launching the B.A. in Legal Studies. Since 2017, he has served as an adjunct faculty member for the M.A. in the Theological Studies program at Martin Luther College. He is author of several books, including Rediscovering the American Republic: A People’s Quest for Ordered Liberty.

In 2012, Ryan and his wife established Into Your Hands LLC to “expand the ability of their own family to serve other families through research, consulting, publishing, training and advocacy consistent with natural law.” Currently, the couple is collaborating on a book offering help and support to parents who homeschool.

“As with Nathan’s family, we also are homeschooling our children in the classical model: history, literature, and even Latin,” says Ryan, who has six children, ages 1 to 13. “The older three work at our book table when I speak at conferences.”

PASSING THE TORCH

Today, Mac still maintains an office home in Glendale, Arizona. Scott and his family live nearby, while Nathan resides in Idaho and Ryan in Minnesota. Thanks to today’s technology, this works seamlessly with the help of their Phoenix-based paralegal and another in Wyoming.

“Truthfully, only about one percent of docketed civil tax cases ever make it to trial in the U.S. Tax Court,” Mac explains. “As to criminal tax cases in U.S. District Court, oft en the lion’s share of the work is plea negotiation, resulting in a plea agreement and perhaps one or two trips to the courthouse.”

Thus, in 2019 the nationwide practice of The MacPherson Group does not mean, as it did when Mac tried 55 cases in 25 states, considerable court appearances. In recent years Mac remotely negotiated plea agreements for cases in Portland, Tucson and Kansas City, and is presently consultant on another Portland case.

Having substantially reduced his case load, Mac now mainly serves as consultant to Scott and Nathan.

“Therein lies the solution to the changing of the guard,” he says. “Working together, Scott and Nathan developed independent practices in the spirit and tradition of The MacPherson Group. They each have a fierce — and stubborn — sense of independence, no doubt attributed to their MacPherson Scottish heritage.”

It was undoubtedly a bit emotional when in 2008 Mac sold his historic office building in Glendale and transitioned to his virtual home office practice, but the move dovetails perfectly with the holistic, national civil and criminal tax practice he has built. Clients continue to range from medical doctors to truck drivers. And, regardless of locale, thanks to the next generation of MacPhersons, it’s a guarantee the proud legacy of The MacPherson Group will continue on for a long, long time.

To view the full magazine, featuring this cover story click here.